6 must-dos to include in your retirement plan while in your 20s

Since we can't predict what the future will bring, it helps to start preparing for retirement early. When you're in your 20s, it's easy to think you have all the time in the world to figure things out and pave the way for financial security. That would be a mistake. It's scary how quickly life passes you by when you take it for granted.

Make the most of your youth by living mindfully, but plan ahead so you can retire in comfort when the time comes. It doesn't mean putting your life on hold though. On the contrary. It's important to live in the present and make the most of each day, but it's equally important to look at the big picture and take small steps towards your retirement goals.

The trick is to start early and to have a clear idea of what those retirement goals look like so you can take small, incremental steps towards achieving them. Your goals might change over time, of course. If that's the case you just need to adjust your plan accordingly, rather than go back to square one.

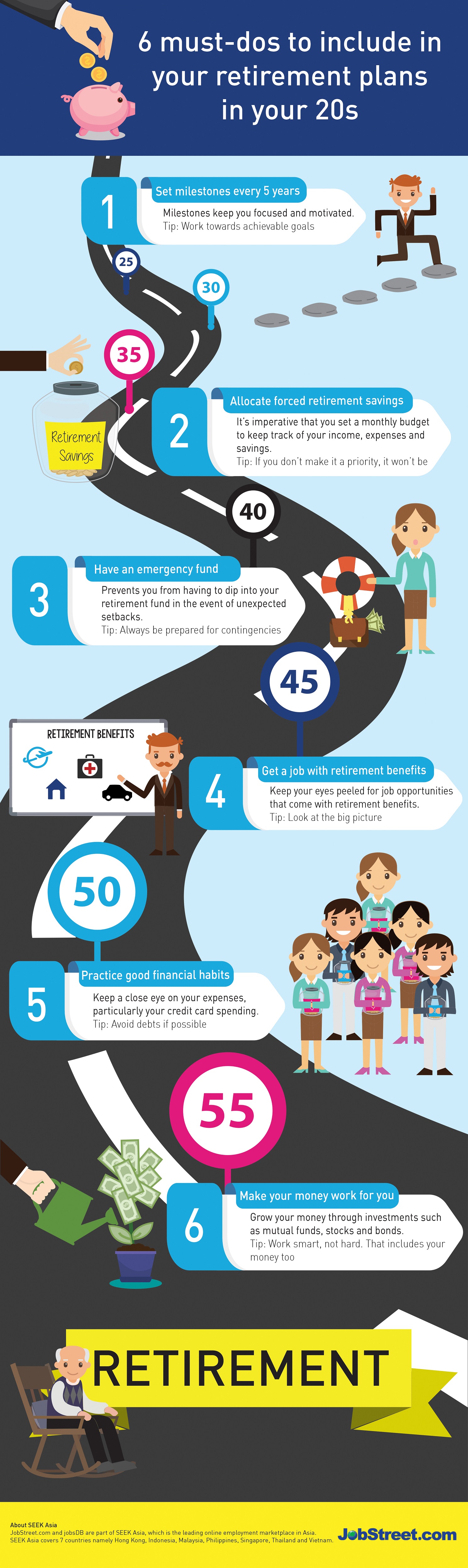

Whatever your goals are, here are 6 must-dos for all young adults to include in their retirement plan to help navigate them through the process:

1. Set milestones every 5 years

Milestones keep you focused and motivated. Rather than working towards a huge goal which could take 30 years to achieve (what an overwhelming thought!), break it up into achievable goals so you can check them off your list as you go. To do this, start by setting a ballpark figure for how much savings you'll need to retire comfortably.

Remember to factor in inflation. If you're only in your 20s now, things will probably cost quite a bit more 40 years down the line. That said, keep it fairly realistic and achievable.

Tip: Work towards achievable goals

2. Allocate forced retirement savings

If you don't already, it's imperative that you set a monthly budget to keep track of your income, expenses and savings. If you're not good with discipline, make it a point to allocate x amount for your retirement savings automatically every month. As soon as your pay comes in, transfer your retirement savings into a separate account. You'll be glad you're doing this once your nest egg starts growing.

Tip: If you don't make it a priority, it won't be

3. Have an emergency fund

Life happens, and when it does, you'll be glad to have a separate emergency fund set aside. This prevents you from having to dip into your retirement fund in the event of unexpected setbacks. It might take a bit more effort on your part, having to allocate savings for multiple accounts, but you can start with small amounts. Something is better than nothing.

Tip: Always be prepared for contingencies

4. Get a job with retirement benefits

One of the advantages of early planning is the awareness you'll have of the issue, so keep your eyes peeled for job opportunities that come with retirement benefits. Even if the hirer doesn't mention it, it doesn't hurt for you to enquire about the possibility of having it included in your contract. Don't just assume they'll say no.

Tip: Look at the big picture

5. Practice good financial habits

It's much harder to fix bad habits than it is to develop good habits from the start. You don't want to be burdened by a life of debts, so keep a close eye on your expenses, particularly your credit card spending. It's best to pay off your bills in full every month and make sure you don't spend above your means, which is often the root of the problem. Don't put yourself in that vulnerable position. It's just not worth it.

Tip: Avoid debts if possible (that includes credit card debts!)

6. Make Your Money Work for You

You probably already know this, but the smart move is to grow your money through investments. The most common ways to invest include mutual funds, stocks and bonds, though there are various forms of online investing available these days. If you're new to investing, speak to a professional investment consultant for advice and guidance. You don't want to place your hard-earned cash in the wrong hands.

Tip: Work smart, not hard. That includes your money too.

Don't worry if you're not making much at present. Start by saving small amounts and your nest egg will grow over time, slowly but surely. What matters most is to save a little each month rather than blowing all your money on things you don't actually need. It's all about priorities.

What do you envision retirement life to look like? Tell us in the comments section below. We'd love to hear your thoughts.

For more fresh insights into career hacking and the latest employment trends, follow our Facebook page !