A Complete and Easy Guide to Income Tax Brackets

Nothing causes as much stress as taxes, but they're not so complicated when you break it down to the nitty-gritty. With tax season upon us, we’ve prepared a quick and easy guide to income tax brackets in Singapore so you can make the most of your income.

Singapore is famous for being a “tax haven.” It has one of the lowest tax rates in the world, on top of being one of the strongest and most progressive economies in the global finance scene. It is one of the reasons international conglomerates build their regional headquarters in Singapore and why investors flock to the thriving local startup scene.

When you consider the country’s advanced infrastructure and competitive industries, it’s clear that your taxes are going to the right place. Here’s how to get started on calculating your taxes.

Who Pays Taxes in Singapore?

Income tax rates in Singapore depend on a person’s tax residency status. Different tax rates apply to Singapore Citizens (SCs), Singapore Permanent Residents (SPRs), and foreigners, so you must know which category you belong to. In summary, there are two crucial tax categories to understand: Tax residents and non-residents.

Residents

If you are any of the following, you qualify as a tax resident:

- Singapore Citizen

- Singapore Permanent Resident

- Foreigner who has stayed or worked in Singapore for at least 183 days in the previous calendar year or continuously for three consecutive years even if the period of stay in Singapore may be less than 183 days in the first year and/or third year. This excludes directors of a company.

- Foreigner who has worked in Singapore for a continuous period of two calendar years and the total period stay is at least 183 days. This excludes directors of a company.

Non-Residents

- If you don’t meet any of the requirements above, you will be considered a non-resident.

What Is Taxable Income?

Your income tax will depend on the following criteria:

- Your income or how much you earn in Singapore

- Your income status as either a tax resident or non-resident

Income taxes are applied on the preceding year basis. We call this the Year of Assessment. The taxes you pay in Year Assessment 2023 will be based on your income from January 1, 2022, to December 31, 2022.

How Much Are Taxes in Singapore?

Resident Tax Rates

A progressive economy requires a progressive tax rate, which benefits employers and employees. Tax residents enjoy a progressive tax rate, meaning that the more you earn, the more taxes you pay. In the same way, the less you earn, the fewer taxes you pay. The tax rates are as low as 0 per cent and are capped at 22 per cent. If you earn less than $20,000, then you don’t have to pay any taxes. If you earn more than $320,000, then the most you have to pay is only 22 per cent of your chargeable income. In comparison to countries with 30 per cent to 50 per cent tax rates, 22 per cent is what you’d consider a steal.

It’s important to note that the tax rates above only apply for the Year of Assessment 2023. This means that the taxes paid in April of this year will enjoy the current tax rate. But the income earned in 2023 will be subject to the new tax rates when Year of Assessment 2024 rolls around.

Non-Resident Tax Rates

Employment Income Taxes

Non-residents do not enjoy the full benefits of progressive tax rates as tax residents. Instead, all non-residents are taxed a flat 15 per cent on their employment income. But if the progressive resident tax rate yields a higher tax amount based on their employment income, then they’ll pay the progressive tax rate instead. Whichever one is higher is the amount they will pay.

Director’s Fee, Consultation Fees, and All Other Income

For Year of Assessment 2023, non-residents will be charged a flat rate of 22 per cent for income coming from rental properties, pension, or director’s fees. But come next year, the 22 per cent rate will be raised to 24 per cent for Year of Assessment 2024.

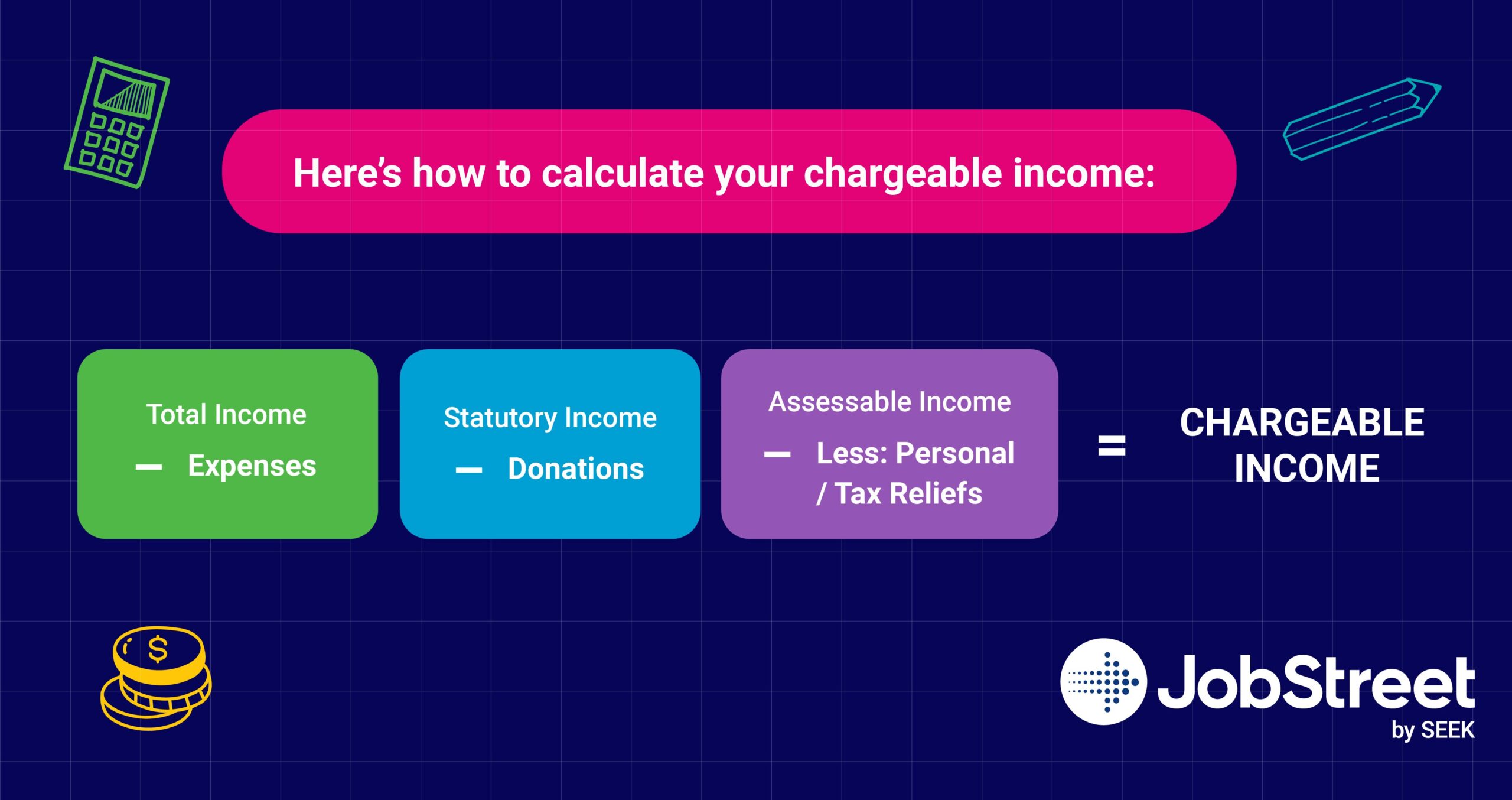

How Do You Calculate Chargeable Income?

Because of Singapore’s tax system, your chargeable income isn’t your gross income. If your gross income is the total amount your employer pays you, then your chargeable income is your total annual income minus employment expenses, donations, and tax reliefs. Singaporeans enjoy a wide list of tax reliefs that you shouldn’t miss out on if you want to make the most of your income.

For a full calculation of your chargeable income, use the Tax Calculator for Resident Individuals for the Year of Assessment 2023.

How Do You Pay Your Taxes?

The deadline for income tax return filing is on April 28. You should have received a filing notification via SMS, email, or letter as early as January. After you receive the notification, the next step is to file your e-File from March 1 to April 18 and pay your taxes.

After you pay your taxes, it’s important to remember that the Year of Assessment 2024 will start applying the new tax rate matrix. So whatever income you earn this year in 2023 will be subject to the new tax rates.

Head to JobStreet’s Career Resources page for more career insights.#SEEKBetterjobs on JobStreet now to achieve your career goals. For more tips from JobStreet, download our app on Google Play and the App Store for easier access.