Accounting and Finance Careers and the Salaries You Can Expect

Accounting is a core function in all industries, offering diverse career opportunities in many areas of specialisation. There are numerous career paths and roles in accounting and finance, along with a wide variety of job levels and remunerations.

Let's take a look at some of the positions within the Accountingand Finance industry, and the respective salariesone can expect at variousjoblevels.

Auditing

Auditors conduct forensic examinations into the finances and transactions of a company or organisation in great details. An auditor is responsible for streamlining financial record-keeping, and is expected to review and advise the company or client on the best accounting procedures. The company's auditor is also expected to provide counsel in the event of external audits conducted by independent parties.

The entry level requirement for an auditor position is usually a bachelor's or master's degree in accounting and auditing.

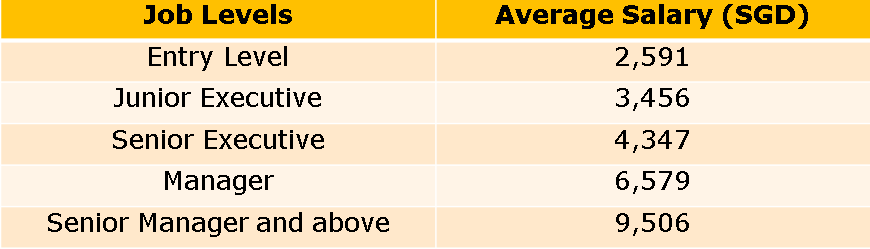

The salaries you can expect in the Auditing pathway are:

Source : JobStreet.com Salary Report 2017

Financial Controller /VP Accounting / CFO

The financial controller and CFO positions are reserved for executives with extensive experience in accounting and finance, and the ability to manage and lead people effectively. The financial well-being of the entire company rests squarely on the shoulders of this key person, and as you would expect, the responsibilities and burdens that accompany the role is huge.

Common academic requirements of a financial controller or CFO includes MBA, as well as degrees in business administration, accounting and economics.

The annual salary you can expect with a senior management or above role within the accounting function ranges from S$120,000 for a Financial Controller, to upwards of S$300,000 for the top CFO position.

Cost Accounting

Cost accountants and cost analysts monitor and analyse the costs of business activities such as equipment purchases, labour and inventory items within the company. They are also responsible for costs data gathering, recording and the reporting of the findings. In most instances, cost accountants routinely identify and provide advice to management on cost-cutting measures so as to reduce operational and production costs in the long-run.

As with most professional roles in accounting, one should have at least a bachelor's or master's degree in accounting or a related field, or a CPA designation, to meet the requirements of this position.

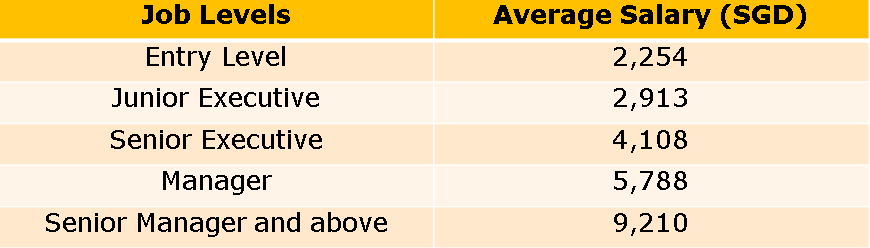

The salaries you can expect in the Cost Accounting pathway are:

Source : JobStreet.com Salary Report 2017

Tax Accounting

The tax accounting specialisation covers accounting services from the simplest preparation of individual income tax returns to the most complex tax planning for large companies.In the corporate setting, besides being directly responsible for the preparation and filing of tax returns of the company, the tax accountant is looked upon to provide professional advice to management or clients of ways to limit their tax liability locally as well as internationally, in accordance to the latest tax laws of the jurisdictions the company operates in.

A CPA, bachelor's degree or master's degree in accounting with specialisation in taxation is usually required for this demanding role.

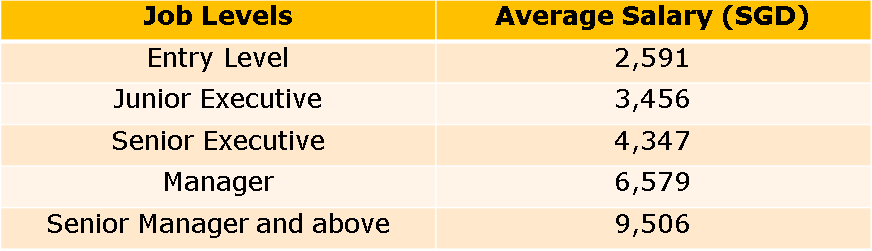

The salaries you can expect in the Tax Accounting pathway are:

Source : JobStreet.com Salary Report 2017

Corporate Finance & Budget Analyst

Corporate finance and budget analysts concern themselves with the optimal capital structuring, sources of financing, and the distribution of resources in the company to achieve the best output. Routine work of a budget analyst involves collaborating with department and project managers to develop the company's budget, and the study and review of each department's budget proposals for viability and compliance with laws and regulations. They also consolidate and prepare budget plans on an organisation level.

This role calls for strong analytical abilities, technical expertise as well as good communication skills, and the minimum academic requirement is usually a bachelor's or master's degree preferably in statistics and accounting.

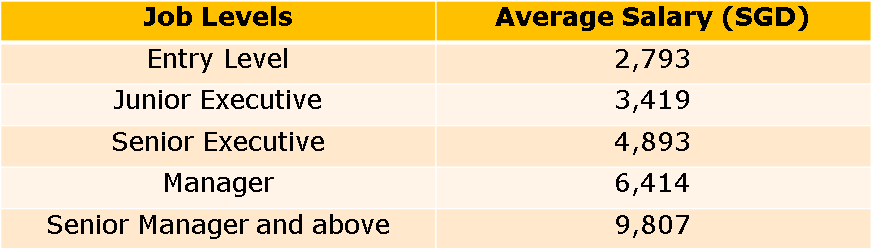

The salaries you can expect in the Corporate Finance pathway are:

Source : JobStreet.com Salary Report 2017

General Accounting

Compared with many other job types that doesn't require a university degree or professional certification, a position in General Accounting as an accounts executive, accounts assistant or a data entry clerk offers a relatively rewarding salary and a solid stepping stone to a long-term career in Accounting. The main roles in General Accounting involve monitoring, recording and consolidating various types of financial transactions in the company.

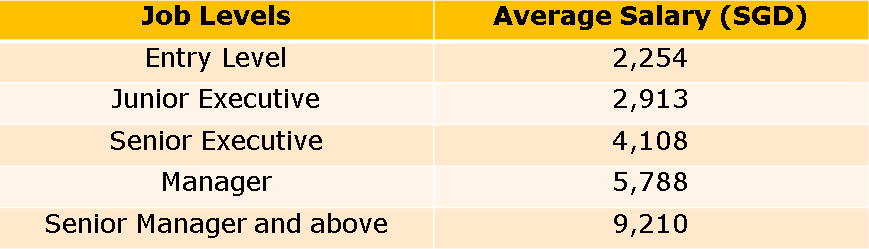

The salaries you can expect in General Accounting are:

Source : JobStreet.com Salary Report 2017

Looking to embark on a successful career in Accounting? Or planning to take your Accounting career to greater heights?Check out the many Accounting positionsavailable on JobStreet.com right now!